Hours after capturing Venezuelan President Nicolás Maduro, President Donald Trump laid out his vision: American oil companies will move into Venezuela, fix the country’s broken oil infrastructure, and “start making money for the country.”

It sounds straightforward. Venezuela has the world’s largest proven oil reserves—300 billion barrels, roughly 20% of the global total. But there’s a problem: U.S. oil giants don’t seem interested.

A Bitter History

American oil companies have been down this road before, and it didn’t end well.

In 2007, Hugo Chávez nationalized Venezuela’s oil sector, forcing foreign companies to hand over majority control to the state-owned PDVSA or leave. ExxonMobil and ConocoPhillips chose to walk away rather than accept what they viewed as a raw deal.

What followed were massive legal battles. International tribunals ruled Venezuela illegally seized assets and ordered the country to pay ConocoPhillips $8.7 billion and ExxonMobil $1.6 billion.

Nearly two decades later, Venezuela still hasn’t paid. ConocoPhillips has collected only a fraction of what it’s owed.

The Infrastructure Disaster

Even if companies wanted to return, they’d face a nightmare scenario.

Venezuela’s oil infrastructure hasn’t been updated in 50 years. Restoring the industry to peak production would cost an estimated $58 billion. The country once produced 3.5 million barrels daily. Today? Barely 1 million—less than a tenth of U.S. production.

The oil itself is problematic too. Venezuela produces heavy, sour crude—thick, sulfur-rich, and among the dirtiest in the world in terms of greenhouse gas emissions. It requires specialized refineries and equipment to process.

Market Reality Check

The timing couldn’t be worse. Oil prices are below $60 per barrel, and the global market is oversupplied. The 2025 oil market saw its biggest annual decline in five years, with prices dropping nearly 20%.

“Companies will be wary to enter without a stable security environment and very favorable terms to reduce the risk, especially with markets oversupplied and prices low,” explains Gregory Brew, an energy analyst at Eurasia Group.

Better Options Exist

There’s another complication: Guyana.

Venezuela’s neighbor recently discovered over 10 billion barrels of cleaner, lighter crude. The government welcomes foreign investment with lower taxes and no state-owned company demanding control. ExxonMobil, which left Venezuela in 2007, is now a major player there.

“All that makes Guyana one of the most attractive oil places in the world,” says Francisco Monaldi, director of the Latin America Energy Program at Rice University.

The Silence Speaks Volumes

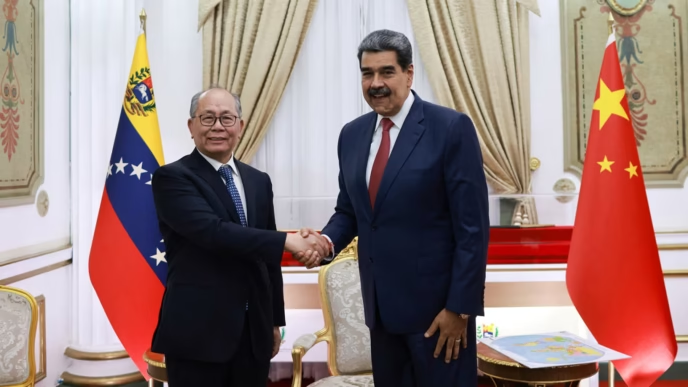

Only Chevron still operates in Venezuela, producing about a quarter of the country’s output. After Maduro’s capture, the company issued a carefully neutral statement about “monitoring” the situation.

ConocoPhillips said “it would be premature to speculate on any future business activities or investments.”

ExxonMobil didn’t respond to requests for comment.

When Trump’s administration floated the idea of returning to Venezuela last month, oil companies “firmly declined,” according to multiple sources.

Who’s Even in Charge?

The biggest question remains unanswered: who’s running Venezuela?

Trump announced Vice President Delcy Rodríguez would cooperate with the U.S. transition. But Rodríguez immediately declared loyalty to Maduro and called the operation “barbaric.” Reports suggest she may actually be in Russia.

“No company is going to want to commit to invest billions of dollars for a long-term operation until they know what the terms are,” says David Goldwyn, a former State Department energy official. “And they can’t know what the terms are until they know what the government is going to be.”

The Bottom Line

Trump’s plan faces serious obstacles: unpaid debts totaling over $10 billion, $58 billion in needed infrastructure repairs, low oil prices, political chaos, and better investment opportunities next door.

The American Petroleum Institute summed it up diplomatically: “We are closely watching developments involving Venezuela, including the potential implications for global energy markets.”

Translation: Don’t hold your breath.

Trump may have captured Maduro, but capturing the interest of U.S. oil companies might prove far more difficult.